ITR Due Date: In a significant development for taxpayers and tax professionals across the country, the Gujarat High Court has urged the Central Board of Direct Taxes (CBDT) to consider extending the due date for filing Income Tax Returns (ITR) for cases requiring a tax audit. This suggestion comes as a potential relief for many who have been grappling with technical issues on the income tax e-filing portal.

High Court Intervenes Amidst Portal Glitches

The division bench of the Gujarat High Court was hearing a Public Interest Litigation (PIL) filed by the All Gujarat Federation of Tax Consultants (AGFTC). The petition highlighted the persistent technical difficulties and glitches faced by taxpayers and chartered accountants on the official income tax portal. These issues have made it challenging to file Tax Audit Reports (TAR) and the corresponding ITRs ahead of the stipulated deadlines.

Acknowledging the petitioner’s concerns, the court observed that the request for an extension was “just and proper.” The bench has directed the CBDT to look into the matter sympathetically and make a decision regarding the extension. The court also pointed out that a similar situation had occurred last year, which prompted the CBDT to grant an extension.

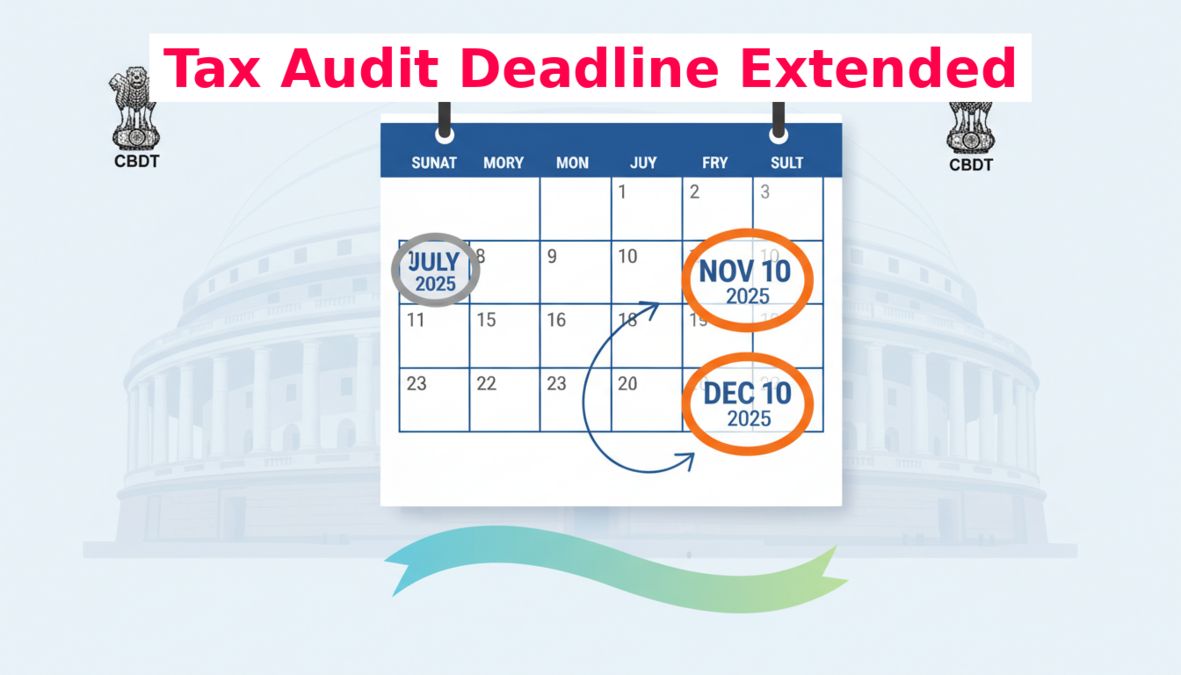

Current Deadlines and Proposed Extension

For the Assessment Year 2023-24, taxpayers who are required to get their accounts audited face tight deadlines. The court’s recommendation is to push these deadlines by at least a month to provide adequate time for compliance without facing penalties.

Here’s a breakdown of the current and proposed deadlines:

| Filing Type | Current Due Date | Proposed Due Date |

|---|---|---|

| Tax Audit Report (TAR) | September 30, 2023 | October 31, 2023 |

| Income Tax Return (ITR) for Audit Cases | October 31, 2023 | November 30, 2023 |

What Happens Next?

The Gujarat High Court has scheduled the next hearing for September 26, 2023. It has asked the CBDT to inform the court of its decision on or before this date. This directive puts the onus on the CBDT to evaluate the ground reality of the portal’s performance and the genuine hardships faced by the taxpaying community. An official announcement from the CBDT is now eagerly awaited by lakhs of taxpayers. If approved, this extension will provide much-needed breathing room for companies, firms, and professionals to ensure accurate and timely compliance without the stress of a malfunctioning portal.