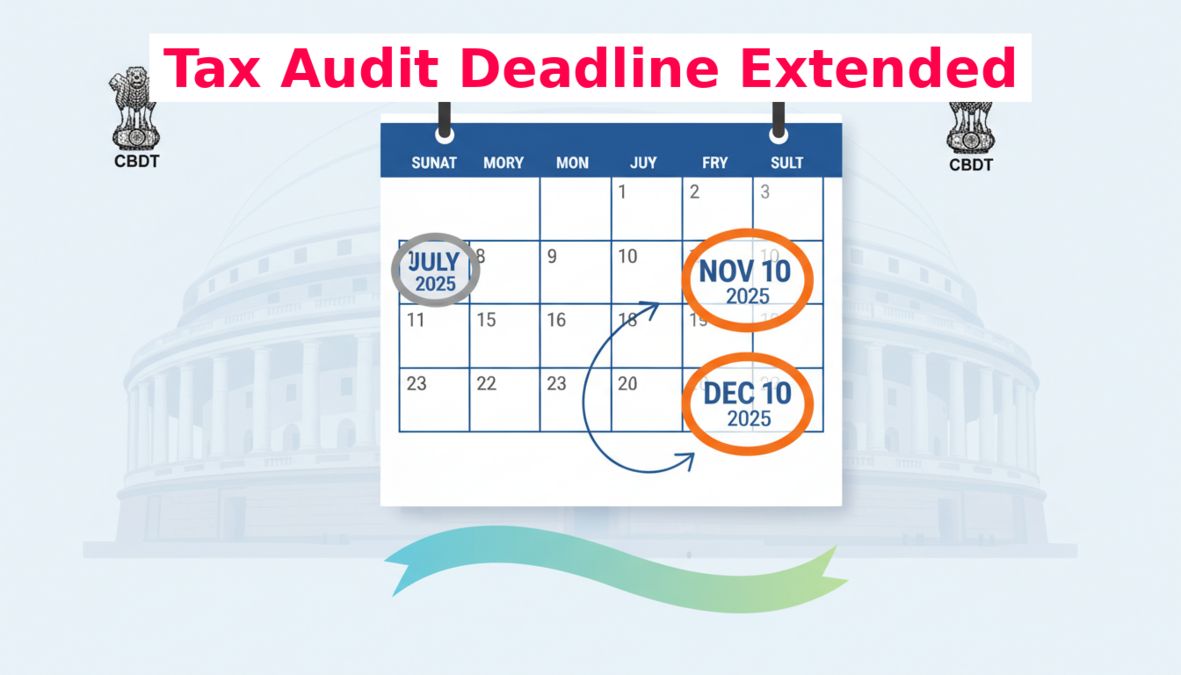

Tax Audit Due Date: The Central Board of Direct Taxes (CBDT) has brought major relief for taxpayers by extending the deadlines for submitting tax audit reports and Income Tax Returns (ITR) for the assessment year 2025-26. According to the new directive, the last date for submitting tax audit reports is now November 10, 2025, and the deadline for filing income tax returns is December 10, 2025. This decision is particularly helpful for taxpayers whose accounts require mandatory auditing.

Previously, on September 25, the tax audit filing deadline was extended from September 30 to October 31, 2025. However, following requests from various trade bodies and tax professionals, the CBDT decided to extend the timeline further. This extension will primarily benefit companies, proprietorships, and working partners in firms.

Why was the deadline extended and who benefits?

The CBDT made this decision in response to repeated requests from trade unions, tax professionals, and courts. Many taxpayers were unable to complete their filings on time due to operational disruptions, natural calamities like floods, and technical glitches on the e-filing portal. This extension aims to ease the pressure on them.

The primary beneficiaries of this extension are companies, proprietorships, and partnership firms whose accounts must be audited. Additionally, many Small and Medium Enterprises (SMEs) and professionals will also find relief with this additional time.

For whom is a tax audit mandatory?

Under Section 44AB of the Income Tax Act, a tax audit is mandatory for certain categories of taxpayers.

- For Businesses: If the total turnover in a financial year exceeds Rs. 1 crore. However, this limit is raised to Rs. 10 crore if cash receipts/payments are 5% or less of the total transactions.

- For Professionals: If the gross receipts from a profession exceed Rs. 50 lakh in a financial year.

Changes in New Deadlines

Here is a summary of the revised deadlines announced by the CBDT for the convenience of taxpayers:

| Particulars | Old Deadline | New Deadline |

|---|---|---|

| Submission of Tax Audit Report | October 31, 2025 | November 10, 2025 |

| Filing of Income Tax Return (Audit Cases) | October 31, 2025 | December 10, 2025 |

What happens if you miss the deadline?

If a taxpayer fails to submit the tax audit report by the revised due date, they can face significant penalties and legal consequences.

- Penalty under Section 271B: A penalty of 0.5% of the total turnover or Rs. 1,50,000, whichever is lower, may be imposed.

- Other Consequences: Interest under Section 234A may be levied on unpaid taxes, and it could lead to increased scrutiny from tax authorities.

Experts advise taxpayers to use this extended period to carefully complete their audits rather than rushing. It is crucial to have all necessary documents, like audit certificates and supporting papers, ready and to upload accurate reports before the new deadlines to avoid any compliance issues.